There’s so much red tape and legal issues to circumnavigate when you buy or sell property in Thailand or any other country. And depending on what country you are in, it will depend on what the laws are, so you really need to understand these things or at least have a grasp on taxes and fees that need to be paid before you buy or sell property in Thailand at Department of Lands.

Before we give you some streamlined ways to calculate your property taxes and so forth in Thailand, it’s important to know what these specific laws are. For sure, you might not fully understand some of them, but you need to fully understand taxes and fees before you buy or sell property in Thailand. Please keep reading below to find out more.

The Basics

Whether you are buying a Thai property for investment reasons or to reside, understanding property taxes is absolutely essential. These sorts of taxes can really make a dent in your investment if you do not know or don’t know how to calculate such taxes and fees. If you don’t factor in these extra costs, by the end of the financial year, you might be losing money or at last out of pocket.

Even if you already own a Thai property or you will be buying said property as an investment to make back rental returns, there are also other taxes to take into consideration. Governments always want their cut, and Thailand is no different. So let’s check out some things that you need to know before you buy or sell your Thai condo or house.

Thailand’s Flat Tax Structure

Before we go any further, let’s begin with the basics. One massive benefit and something that really does entice foreign investors and buyers to purchase Thai property is a flat tax structure that doesn’t have any hidden fees or costs. Some of the countries bordering Thailand have a more complicated and less transparent take on tax structures.

You will not receive any annual income tax charges for owning a property in Thailand. This blanket zero-tax policy on starts when the property is sold, and that’s something you need to think about. It’s quite a good thing for foreigners who want to buy a Thai property.

Taxes and Fees on the Sale of a Property in Thailand

There’s a standardized fixed transfer fee of 2% that is imposed by the Thai Government that is slapped on the sales figure of a property that is sold or being purchased. In most cases, this fee is shared by the buyer and seller who split the tax to pay 1% each. It’s the responsibility of both parties, so is usually halved between both. However, the split can also be negotiated by both parties and put in the terms of the sale. It’s also important to remember that if the said property has been owned for at least five years, there will be a stamp duty tax of 0.5% imposed.

Business tax on sale…

There’s a business tax of a 3.3% levy on the sale of a property in Thailand that is calculated from the sales price or even in some cases, on the appraised value, depending on which one is higher. This tax is paid through the sale of the property. This figure is made up of 3% for Specific Business Tax and 0.3% for the local tax, all of which are applicable in a commercial or profitable manner for the immovable sale of the real estate or property.

It’s important to understand that this tax is only applicable during the first five years of property ownership. If the said property is acquired via inheritance, the tax figure is not applicable and is essentially waivered no matter how long the property was initially owned.

Property tax on sale…

Once the property has been sold, property tax will be applied to the sale. This will be based on a progressively calculated withholding tax structure that is essentially taken from the appraisal value or sales price, depending on which is the highest figure. This will also be calculated in relation to how long the property has been owned and the duration of the ownership.

Withholding tax…

Working out the Withholding Tax can be difficult unless you know what you are doing or have access to a Thailand property tax calculator to simplify the job. You can calculate this by using the gross income of the selling price and then using the deducting expense percentage to find out the net income. You can then divide that net income figure by the years that the property has been owned to find the annual net income.

You can also use that yearly net income figure to work out the annual tax income. From there, you need to multiply the yearly tax income by the number of years that the property in question has been owned, and that will give you the Withholding Tax number.

You can calculate the withholding tax by using the sales price for the income and then by deducting that from the Deductible Expense percentage to calculate the net income and then by dividing that by the years the property has been owned to find your yearly net income. Now you can take that yearly net income figure to work out the annual personal tax income. The final part of the process is to now multiply the tax income per year by the years that the property has been owned and you have your Withholding Tax figure.

Withholding Tax Calculation Example

Here is an example below of the step-by-step tax calculation process based on a property with a sales price of 10 million THB.

Sale Price (Income) – 10,000,000 THB

Deductible Expense (84%) – 8,400,000 THB

Net Income – 1,600,000 THB

Net Income (per year) – 800,000 THB

Net Income Tax (per year) – 75,000 THB

Withholding Tax is… 150,000 THB

Once the calculation process has been made on this 10m THB property, the Withholding Tax is 150,000 THB.

Using a Thailand Property Transfer Tax Calculator

Let’s be honest here, how many of you are mathematicians? Not many, right? Me neither. The truth is that you don’t need to be a math expert or even a lawyer to calculate Thai property taxes when you buy or sell a condo or house in Thailand. Hiring a lawyer who is an expert on Thai property taxes is an additional price you don’t really need to pay, not when you have access to the precise and extremely helpful online Thailand Property Transfer Calculator.

At Hero Realtor, we have created a property transfer calculation that lets you cut through all the legal red tape to calculate how much property taxes you need to pay. You can CLICK HERE to access this Thailand property transfer tax calculator to simply find out the figure without all the usual hassles.

How to use the Thailand Property Transfer Tax Calculator?

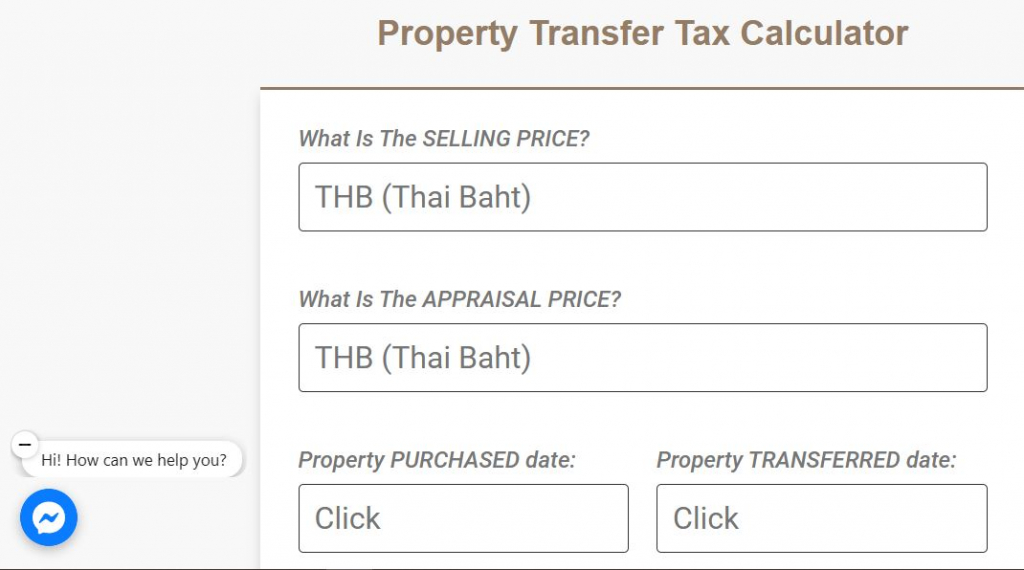

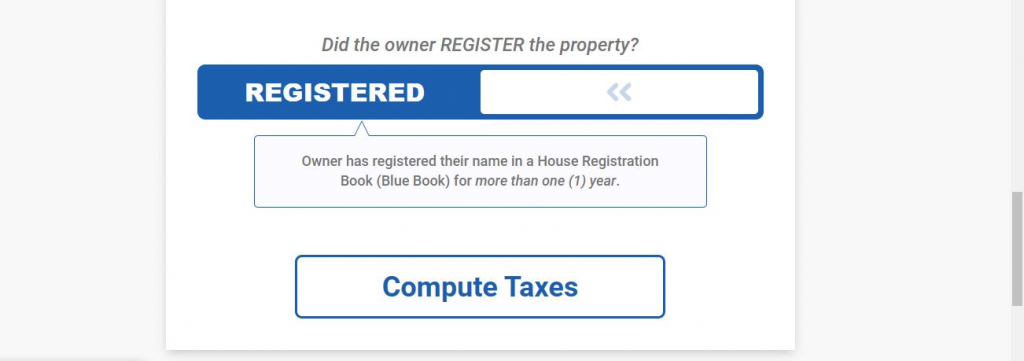

All you need to do is fill in the fields with information. You need to enter the selling price in THB in the first field, the appraisal price in the second field, the date of the property purchase, and the date of the property transfer date. You will then need to select a few more details underneath about if the property is registered, info about the owner, and also the type of property, and you are almost finished.

Once that info is entered into the fields, you click on the “Compute Taxes” button and the calculator will give you the exact figures you need to pay for the below taxes:

- Transfer Fee

- Stamp Duty

- Business Tax

- Withholding Tax

- TOTAL TAX

It really is that simple guys when using this Thailand Property Transfer Tax Calculator. For sure, you can pay a lawyer to do that for you, but with so many fees, using this calculator will simplify everything for you.