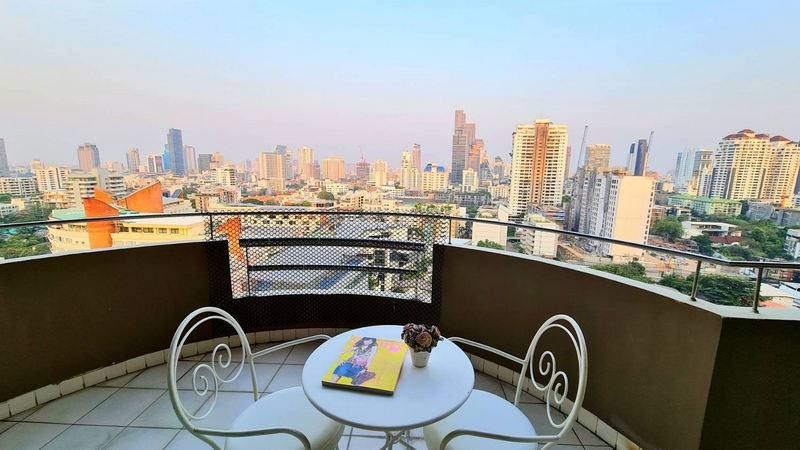

It can be a real minefield buying property in Thailand when you are Thai, never mind being a foreigner. And there are also so many properties to choose from. For example, you can buy a luxury Bangkok condo for about THB 500,000 per sqm or a beachside house in Phuket for much more.

But the truth is that it can be a complicated process to buy Thailand property. I would suggest getting a lawyer that understands Thai property law. It’s probably better if you don’t go it alone. But even if you get a lawyer, it’s still important to know what you are dealing with.

In this article, I am going to cover everything about the subject. This is a complete guide to buying property in Thailand that will cover if foreigners can buy houses and condos in Thailand, the process of buying both villas and apartments, finance, property taxes, and everything in between.

Can a foreigner in Thailand buy a property?

It’s complicated like a Facebook relationship status. Joking aside, the laws covering foreigners buying property in Thailand are very strict, even by Asian standards. You can’t just buy a commercial property as a foreigner in Thailand. There are some workarounds. For example, a foreigner can buy 49% of the units in certain projects in a branded development that is called strata-titled projects.

But even if you can find these types of condos, they are scarce on the ground. As a foreigner, land ownership in Thailand is restricted. That makes it even more difficult to buy villas. The truth is that you don’t really have to buy the land, as you can lease it.

1. Thailand Property Leasing Rules

It is possible to lease land in Thailand as a foreigner and the maximum time frame is 30 years. It is possible to renew this three times which culminates in 90 years, so it is similar to owning a property in Thailand. This deal gives you the right to own the land for a certain amount of time. You can put a stipulation in the contract that the leasehold period needs to be renewed.

2. Using a Thai Limited Company to Buy Property

You could set up a Thai limited company ad use it to buy a property. The only issue is that you will only own 49% of the shares in the limited Thai company. It is possible for Americans to do this because of the “Treaty of Amity and Economic Relations” deal that was originally signed between Thailand and the USA in 1966.

You as the foreigner, can appoint yourself as the director of the company that gives you the majority of the voting rights. I would not recommend this route because it’s fraught with potential issues. And you will receive very little help from the Thai authorities if everything goes pear-shaped.

3. Use a Spouse to Buy Property in Thailand

It is possible to buy property in Thailand by using a Thai spouse to do it. The only issue here is if you file for divorce from your spouse, the property will be treated as your spouse’s asset.

Buying Condos in Thailand

It’s most common for foreigners to buy condos in places like Bangkok and Phuket, and this is largely because condos are easier to buy than houses. The ownership laws for buying condos are much more favorable to foreign ex-pats in Thailand. And they also have great onsite facilities that can simplify your lifestyle.

Two notable benefits of buying condos are:

- You can get freehold ownership

- The condo is registered with a title deed, similar to a strata title

If you do not understand title deeds, they are documents that give legal proof that you own the said property. It also lists all your rights as the owner. On the other hand, Strata title deeds are mostly used when you are buying properties in multi-level developments that have lots of facilities and communal areas.

Foreigners Buying a Villa in Thailand

Not all foreigners want to buy Bangkok condos in the city. Many come to Thailand to leave near the beach, and this means they usually have to buy villas near the beach in places like Phuket and Koh Samui. Here are some of the things you have to think about before buying a villa instead of a condo:

- More privacy

- A potentially bigger price appreciation

- Living closer to nature / the ocean

- More convenience and space if you have a family

But just remember that if you do buy a villa or house, the process is way more complicated. You will need to make plans to visit the land department and land office, while also going through lots of checks on the villa’s condition. It’s highly unlikely you will find a villa in the middle of Bangkok city, but Hua Hin, Phuket, Samui, and Pattaya are wiser picks.

How Can I Pay For a Condo Unit in Thailand?

There are a few ways you can pay for a condo or property in Thailand. If you did want to buy with cash, you’ll need to have the fund legally transferred into a Thai bank. And that’s not as easy as it might sound. For example, you will need to understand more about the process of transferring money into Thailand before you attempt to do so. The money must be converted from the currency of your home country to the Thai baht before you can buy a property.

Once you’ve done that, the bank will make a copy of a FET form (Foreign Exchange Transaction Form). These details will be included on the FET Form:

- The transferred amount in your chosen foreign currency

- The amount converted into Thai Baht

- The name of the sender

- The name of the beneficiary

- The purpose of the transaction

In the eventuality that you don’t get issued a FET form, you might have the option to provide a Credit Note and a Letter of Guarantee. On these documents, most of the same info as above will be used. This is essentially an official reporting form called a “Foreign Exchange Currency Transaction” document.

You need to fill in this form when you are moving your money from your home country to Thailand. These forms need to then be handed over to the Land Office, as they manage the ownership transfers.

Can a Foreigner Get a Mortgage in Thailand?

In previous times, a foreigner couldn’t get a mortgage in Thailand. And although it’s still pretty difficult, it is possible. But there are lots of restrictions and red tape. If the bank in question has offices and branches in both Thailand and Singapore, that should help.

Requirements to get a local bank loan in Thailand

Not all banks provide this type of service. But the ones that do have some requirements that need fulfilling on your part. Bangkok Bank is a great example to explain things better. Here is some info from the Bangkok Bank website about the requirements and what you need to do as a foreigner to get a mortgage in Thailand:

- You need to be older than 20 years old

- The loan payment duration needs to be under 30 years

- The applicant’s age and the loan period cannot exceed 65 years when added together

- The maximum loan amount granted will normally be up to 80% of the appraised value

Can I Get an International Property Loan?

The safer bet for a foreigner wanting to buy property in Thailand with a mortgage would be to get an overseas property loan in your home country. It makes the most sense. However, foreign banks such as ICBC, the Bank of China, and UOB are decent choices for those looking for a mortgage. It all depends on your country of residence. For example, if you are a Singaporean, UOB is the perfect choice.

Real Estate Taxes

Before you decide to buy a unit, you must understand your tax obligation when purchasing, holding, and selling the unit.

Below I have listed the most important taxes you have to pay when buying properties. Additional fees might apply, confirm with your agent if that is the case.

Transfer Fee

The transfer fee is calculating the property value by 2%. It’s generally paid by the buyer but this can be negotiated. The fee is sometimes split between the seller and buyer.

Stamp Duty

Stamp duty of 0.5% is charged and multiplied by the property value. It’s paid by the seller at the time of the transaction.

In short, stamp duty is a tax placed on legal documents during the transfer of the ownership of the property.

Withholding Tax

A withholding tax is charged that increases progressively, depending on how long you own the property. The taxable amount is calculated by multiplying the sales value by a deduction factor in percent. The deduction factor ranges between 0.08 – 0.5%, the longer you hold the property, the higher the deduction rate.

For more information on how to calculate withholding tax, you can click here to find our Thailand property tax calculator.

Final Thoughts

At Hero Realtor Bangkok, we can help you every step of the way whether you want to buy or rent a Bangkok property or even if you are trying to sell or rent out your property in Bangkok. For more details, you can email us here at contact@herorealtor.com