If you are trying to understand Thailand Land and Building Tax laws, it can seem like a complicated affair. But as with most things in life, it’s never as complicated as you think. The Thailand property laws can be a bit up in the air at times, so we’d always recommend that you hire a lawyer that specializes in these types of things.

But it doesn’t hurt to do your own research so you are armed to the teeth with knowledge. Did you know a new type of tax came into effect on 1 January 2020? It was created to replace the previous ‘local maintenance tax’ and ‘household and land tax’. Let’s find out more about this new tax type and fill in the gaps of information that you didn’t already know.

What is Thailand Land & Building Tax?

A good place to begin is at the start. Thailand Land & Building Tax was first announced back on 12 March 2019 in the Government Gazette. The act was created in order to encourage landowners to use their land instead of leaving it abandoned, derelict, or unused. It’s to get landowners to develop their land instead of leaving it dormant.

Who Should Pay Thailand Land and Building Tax?

We always get asked who is liable to pay Thailand land and building tax. Why does it need to be paid? And what does it involve? Under Section 37 of the Land and Building Tax Act, the tax will be collected from buildings or land that are used for the following purposes:

- For all types of agricultural purposes. This will include rice farms, plantations, livestock farming, carp farming, and all types of animal farming. If you’re a farmer, you seriously need to follow this act.

- For any type of residential purpose.

- Any other purposes that don’t include residential or agricultural.

- Any building that is left unused and empty.

Are Any Buildings or Land Exempt from Tax?

Sometimes when trying to understand any form of complicated regulations, it can be difficult to get precise info. Maybe your building or land is exempt from tax, but how would you know? Please see a list of land and building types that are tax-exempt under Section 8 of the Land and Buildings Tax Act.

- If the property is from the state or a state agency that is routinely used for public things. And then this type of building is not used for any beneficial purpose.

- When the property is used or serves as an office or building for the United Nations, or other specialized agencies or international organizations. This tax exemption could also be when Thailand is bound to grant tax exemption or treaties from other agreements.

- If the property in question is used an international embassy o some kind of consulate for a foreign nation. And this is also in accordance with the reciprocity principle.

- If the property is used for the Thai Red Cross organization.

- If the property is owned by a religion or any type of religious organization that carries out public or religious activities. It could also be a dwelling place for monks and other religious clergy or representatives, or if used as a shrine and anything that is non-profit related.

- If the land or property is a non-profit public graveyard or a public crematorium space.

- If the land or building is used or owned by a charity or some kind of foundation that helps people.

- If the build is privately owned and is used largely for public interests or for public and charitable benefits for the betterment of others.

- If the building is mainly used for the common benefits of co-owners that come under the current Thailand condo laws.

- Any kind of public utility land that comes under Thai land development laws and regulations.

- When the land is a public utility that comes under Thailand’s laws in the Industrial Authority of Thailand act.

Are There Other Land & Building Tax Exemptions?

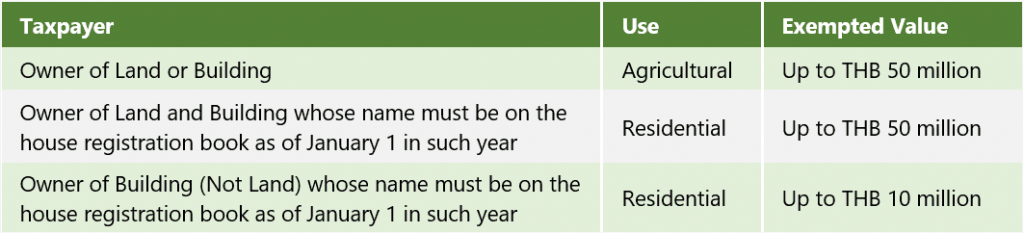

Now we’ve covered areas where building and land tax are needed and exempt, it’s time to look at some other issues. What other types of land and buildings are tax exempt? If a building or landowner uses that land for agricultural purposes, they get tax exemptions if the tax total does not exceed 50 million THB.

If you’re the owner of land or buildings that are used for residential purposes and your name is listed on the house registration certificate from 1 January of that tax year, you’ll be exempt from tax if the figure does not exceed 50 million THB.

In the case of those who only own the building and not the land it’s built on, and then build on that land, if your name is on the house registration certificate from 1 January on that tax year, you’ll be tax-exempt for the figure if it doesn’t exceed 10 million THB.

When Should I Pay the Tax?

You will be notified by February each year by the local authorities of the amount of tax you need to pay for the year. And then you should pay that noted tax total by April every year.

Where do I Pay My Thailand Land and Building Tax?

There are a few places where you can pay your Thailand land and building tax. Please see a list of the locations below:

- Your local Municipality Office for land or buildings.

- Your local Tambon Administrative Organization is for land and buildings.

- If you’re located in the Bangkok Metropolis Administrative area, you can visit the Khet Office for buildings and land.

- If you live in Pattaya, you need to visit Pattaya City Hall.

- Any type of government office or organization that is specified by the law for buildings and land.

Are There Penalties for Late Tax Payments?

You will receive a written warning from the local government in May for any unpaid taxes that you incurred. You will then be expected to pay your overdue taxes with further fines and a surcharge. If you have failed to pay your tax within the allotted time frame, you might be liable for a penalty payment of 40% of the overdue tax total.

If you did manage to pay your taxes late but before the written warning notice, you will receive a penalty of 10% of the overdue tax total. And if you failed to make the tax payment on time, but did pay within the allotted time frame on the written warning, you are liable to pay a penalty of 20% of the overdue tax total.

Al these failures to pay your tax comes with a 1% surcharge per month no matter which phase you failed to pay. It’s important to pay your taxes on time, and if you do falter, get it sorted as quickly as possible.

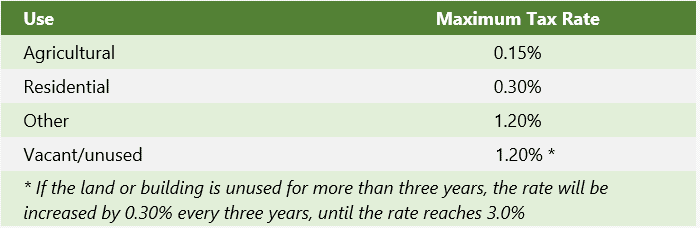

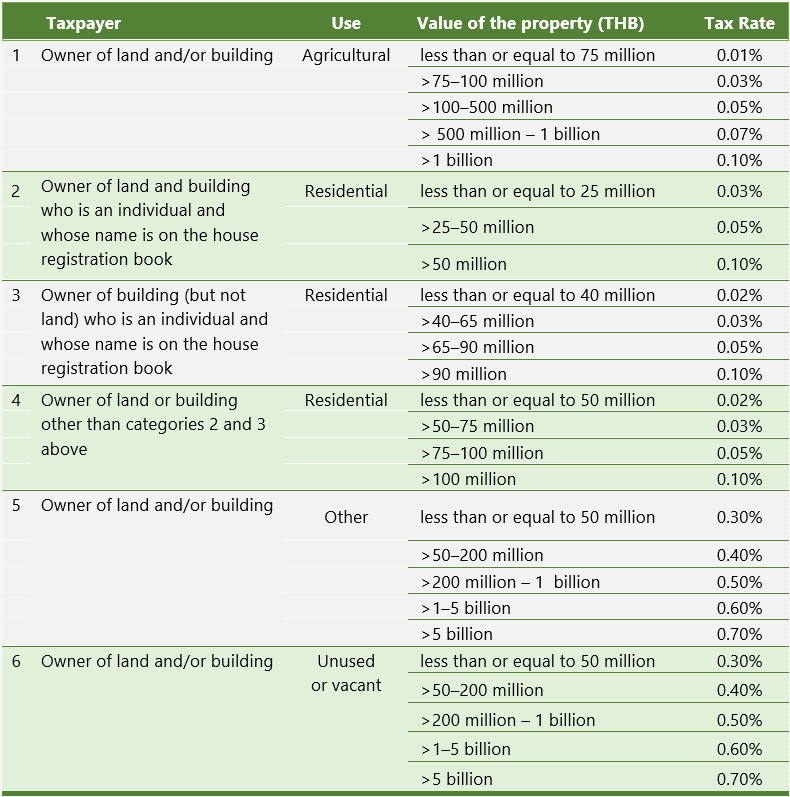

Here are some good examples and figures for you to understand land and building taxes in Thailand.

Thailand Land & Building Tax Minimum Rates:

These are the limited exemption examples for owners that meet the below criteria:

Transition period rates for the first two years of tax collection in line with the new rules that started on 1 Jan 2020:

Final Thoughts on Thailand Building & Land Tax

As you can see, there is a lot more to Thailand building and land tax than meets the eye. It’s always important to understand exactly what you are dealing with. We suggest that you get proper legal representation so you are not left in the dark holding the bag.

For any more questions or queries, you can email us at contact@herrrealtor.com